All You Need To Know Regarding Payroll Tax Holiday

By Jaden Miller , June 14 2021

When the coronavirus pandemic hit the world last year, the US economy took a severe hit. To help ease the financial burdens on fellow Americans, President Trump signed a payroll tax holiday executive order last August, allowing employers to temporarily suspend the 6.2% federal payroll tax withholdings that go toward Social Security.

But what is a payroll tax holiday, have you been put on one, and how will it affect you? While the intent was for workers to see more money in their monthly paychecks, the so-called tax holiday wasn't that simple. The payroll tax holiday was in effect from September 1 through December 31 - a measly four months. Now that the payroll tax holiday has come to an end, all who benefited from the tax break have now gotten an unpleasant surprise - four months of deferred tax withholdings to pay!

As of January, all the money that went unpaid in taxes for the duration of the payroll tax holiday was then requested back. This means that rather than paying the regular 6.2% tax rate, employees who took part in the tax holiday had to cough up 12.4% of their pay from January 1 through April 30.

Unfortunately, most individuals that needed the financial aid of the payroll tax holiday still weren't financially able to start paying taxes again by January, let alone pay the repayments, too. Sound familiar?

If you're in a similar situation or want to know more about the payroll tax holiday you might have received, keep reading!

Table of Contents:

-

What are Payroll Taxes?

-

FICA

-

MEDFICA

-

-

What is a Payroll Tax Holiday?

-

How Does it Work and Who Does it Apply to?

-

Payroll Tax Holiday Income Eligibility

-

Payroll Tax Holiday Employer Participation

-

-

-

Does Law Require the Payroll Tax Holiday?

-

Is Payroll Tax Holiday Forgiveness an Option?

-

Have There Been Other Payroll Tax Holidays Before?

-

How to Cope With Your Payroll Tax Holiday Repayment

-

Use Some Savings

-

Work on Your Budgeting

-

Boost Your Income

-

-

Conclusion

What Are Payroll Taxes?

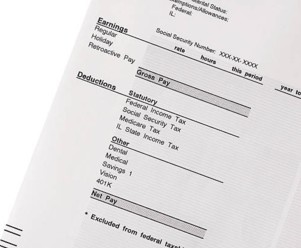

Before you can understand all there is to know about payroll tax holidays, you first need to know what payroll taxes are. Put simply, payroll taxes are the taxes you pay on your wages. These taxes are used to fund programs such as Social Security and Medicare. There are two types of federal payroll taxes that are the largest and most noticeable - you'll probably know them as FICA and MEDFICA on your paystubs.

FICA

FICA helps to fund Social Security and is taxed at a rate of 12.4% of your earnings. Luckily, you don't have to pay the full 12.4% - your employer will pay half of this, so you'll only have to pay 6.2%.

MEDFICA

This tax helps to fund Medicare. MEDFICA isn't taxed as highly as FICA; however, it's still an ample 2.9%. But, again, your employer will pay half of this percentage, so you won't be stuck paying the brunt of these taxes.

What Is A Payroll Tax Holiday?

So, now that you know what payroll taxes are, precisely what is a payroll tax holiday? Trump introduced the new payroll tax holiday in light of the current COVID 19 pandemic to aid those struggling financially. This tax holiday lasted for four months, where taxes were temporarily paused so that employees could see a boost in their pay.

Although the paused payments were classed as a tax 'holiday', the payments were only deferred and not actually paused. This means that the whole four months worth of payroll taxes that went unpaid were actually totting up behind the scenes for all those on a tax holiday ready to pay as of April.

How Does It Work And Who Does It Apply To?

Payroll tax holidays work by lowering your payroll taxes - if you were put on a payroll tax holiday, you would have stopped paying your 6.2% Social Security tax, which means your monthly wage slips would have shown a pay increase. While your Social Security tax would have been deferred, you still would have continued to pay other taxes such as Medicare.

This temporarily lowering of payroll taxes was supposed to help stimulate the US economy during the pandemic by giving more money to workers. The payroll tax holiday was also supposed to incentivize companies to hire new employees, as it reduces hiring costs.

Payroll Tax Holiday Income Eligibility

Payroll tax holidays were only offered to employees making less than $4,000 biweekly, or $104,000 annually on a pre-taxed basis, as those who were earning higher weren't seen as financially struggling. Ideally, this type of payroll tax deferral was intended for middle-class workers who were unable to claim unemployment benefits but who still needed extra support during the pandemic.

If you fall within this eligibility, it doesn't necessarily mean you've been put on the tax holiday - your employer makes this decision.

Payroll Tax Holiday Employer Participation

You cannot decide whether to participate in the payroll tax holiday; your employer has to make this decision for you. Since your employer collects payroll taxes, it's up to them if they want to go ahead and set up the holiday program for their employees. While many federal government agencies participated in the tax holiday, large corporations and big businesses have opted out of the program due to several issues. There are two main reasons why employers chose to opt-out of the program:

The first reason is that since the 'holiday' is only a deferral, employees would still have to pay the taxes eventually unless the debt is forgiven. Most businesses were skeptical that the pandemic would be over by April (now we know that it's still very much ongoing) and so saw the potential damage it could cause by opting in.

Adding an additional 6.2% financial burden on top of their already overwhelming finances could be worse than any benefit gained by those four months of deferred taxes. The second reason is more about saving the company, rather than helping the employees. Even if employees leave their place of work, those taxes are still owed to the US Treasury (not the IRS).

So suppose an employee leaves their current workplace, that leaves the employer on the hook to pay those deferred tax bills. Now, this is a bad situation for any employer to deal with in general, but when you add the uncertainty of the economy due to a pandemic, the risks are too great for many businesses.

Does Law Require The Payroll Tax Holiday?

Unless you're a federal government employer, payroll tax holidays aren't required by Law. The program is optional for private firms, so your employer can weigh up the pros and cons before deciding whether or not they want to enroll. If your employer has opted into the payroll tax holiday, it's highly likely that this will be in effect for all current employees or ones that have agreed to opt-in.

As an employee, you don't have a given 'right' to a tax holiday if your employer doesn't want to opt-in. It's not illegal for an employer to continue to withhold the typical amount of payroll taxes from your pay, as they legally don't have to give you a payroll tax holiday at all. This shouldn't be seen as a negative, though. Payroll tax holidays are just delaying the inevitable - whether you pay your taxes now or pay them later, they will end up being paid.

Is Payroll Tax Holiday Forgiveness An Option?

Payroll tax forgiveness was suggested a few times by Trump, with the previous President stating he would forgive the tax debts if he were re-elected. Unfortunately, he wasn't, which left the new President Biden the difficult decision of what to do - he could either forgive the debt or request payroll tax holiday repayments. Biden chose to go ahead with the repayments.

Payroll tax holiday repayment was set to begin in January. However, there were a few changes made to help struggling individuals further. While Biden didn't offer payroll tax holiday forgiveness, the length of time to pay off the debt was extended. Instead of workers paying double in taxes for the next four months starting from April, the owed amount would be spread over the entire year of 2021.

Payroll tax holiday repayment is now running until December 30 of 2021, and employees will only pay one-third extra Social Security tax for 12 months rather than the double tax for four months. After the new due date, any remaining unpaid payroll taxes from 2020 would incur a penalty, interest, or other charges, that employers will have to pay - this is because employers have the responsibility of collecting these payroll taxes.

Have There Been Other Payroll Tax Holidays Before?

In 2010, Congress approved a 2% payroll tax holiday for 2011 to 2012, taking payroll taxes for Social Security from 6.2% to 4.2%. This was to help stimulate the economy during the George H.W. Bush-era tax cuts and those two years of tax holidays resulted in a $10 billion loss per month to Social Security.

Since then, there haven't been any other payroll tax holidays other than the current one applied by Trump. Unfortunately, as history has shown, these 'holidays' haven't created much economic stimulation compared to the damage they have caused - a $10 billion loss per week is devastating for the Social Security Administration.

How To Cope With Your Payroll Tax Holiday Repayment

Knowing what a payroll tax holiday is and knowing if you've been enrolled into one is vital, as you'll have to prepare for the extra payments coming up - that is, unless your repayments haven't already started. Whether you've yet to pay towards your tax holiday repayments or you're currently struggling to pay them, there are some things you can do to help you cope financially.

Use Some Savings

If you have any savings set aside, it might be worth dipping into these to help ease your extra tax payments. When the payroll tax holiday scheme was set into motion, a few smart people suggested setting aside the extra money from the holiday in preparation for the upcoming tax repayments. If you were smart enough to do this, you'll have no problem paying back the deferred taxes.

Work On Your Budgeting

One good thing to come out of the pandemic is our newfound closeness to our finances. As times have gotten tough, we have to be a lot more cautious about where our money is going. Learning to budget has become a significant new step in coping with payroll tax holiday repayment. You can find some great budgeting apps to help budget your finances better if you need the extra help!

Boost Your Income

People have gotten a lot more creative since the pandemic hit, and hustling is now a daily occurrence. To cope with the coronavirus's financial implications, many have taken to freelancing, selling unwanted items, and even turning hobbies into a source of income. If you can find an extra source of income to boost your monthly wages, you'll be able to pay those tax repayments in no time at all!

Conclusion

Now that we've discussed every possible avenue there is to discuss payroll tax holiday payments, you'll be able to work out your next move easily! Whether you just want to prepare for any tax holidays in the future, or you need some support with your tax repayments right now, everything you need to know is in this blog.

Although the current payroll tax holiday has come to an end, if there's ever another one in the future (and there very well could be - the pandemic isn't over yet), you already know what is a payroll tax holiday, what payroll tax holiday repayment is, and what your options are in regards to opting in or out. Now all that's left to do is wait for another payroll tax holiday executive order announce. Care to try out our services? You won't be disappointed!

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!