What Is A W2 Form?

Do you know much about your form W2? How about a W2 online? Let’s discuss this form further, what it means to receive a w2 online or a hardcopy form. Every year during the month of January, you receive an envelope in your mail from your employer. Some of you rush to open it, examine it, and send it to your tax professional.

Others, well, we’ve seen cases where tax professionals receive W2 forms that are not even checked let alone opened. So you see, it’s really not all that uncommon to find individuals at a loss when it comes to their tax form or their W2 online. Read on further to explore and get a better understanding of the form W2.

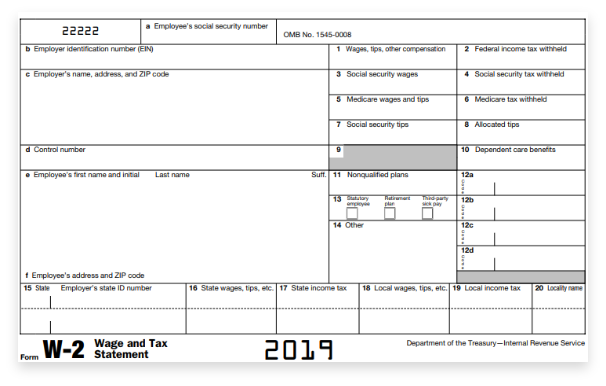

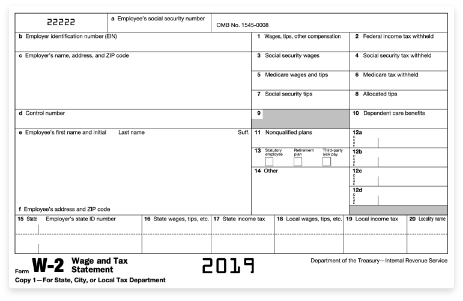

A form W2 Or a W2 Online is usually issued by your employer. It is one of the most important tax documents and you should be very aware of its details, figures, boxes, and significance. A form w2 displays the amount of taxes taken out from your paycheck for the entire set year and is sent out to you once at the beginning of a new year so you can file your tax return. Your employer is responsible to ensure that certain withholding, insurance and reporting requirements are mentioned clearly.

A form w2 or form W2 Online is also known as the informational return. A term coined by the IRS since this document contains sensitive information about your earnings and taxes paid and must be sent out to several concerned parties. Every year your employer must send out a copy of your w2 form or w2 online to: