What Is FICA Tax on My Paystub?

By Davis Clarkson , June 11 2025

Ever stared at your paystub wondering where half your paycheck disappeared?

That mysterious FICA deduction might be eating up more of your hard-earned money than you realize.

If you're like most working Americans, you've probably asked yourself, "What exactly is FICA, and why is it taking such a big bite out of my pay?"

You're definitely not alone in this frustration.

FICA is one of the largest deductions you'll see on a paystub, yet most people have no clue what it actually funds or why it's mandatory.

The truth is, understanding FICA could be the key to making sense of your entire paycheck.

We're here to break it down in plain English so you can finally get answers to those nagging questions about where your money really goes.

The Origins Of FICA

FICA stands for the Federal Insurance Contributions Act, originally created in 1935 by President Franklin Roosevelt. Though, it was not labeled FDIC. Instead, it was simply called the Social Security Act (SSA). The purpose of creating this act was to provide elderly and retired individuals with money for retirement.

While it was originally designed as a voluntary program, it is no longer voluntary. Anyone who works and earns income must pay into this fund. Read on to find out more about what is FICA.

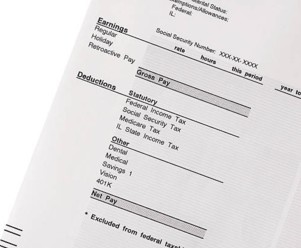

What Is FICA On My Paystub?

The money the U.S. government collects from FICA taxes is used primarily for two main things. FICA covers Social Security retirement payments but also covers premiums for Medicare — a federally funded healthcare program for seniors. Review these 2 main points below to understand the importance of what is FICA on my paystub and why it is needed.

1. Social Security Payments

Social Security is a program run by the government that offers money to people after they retire or for people who qualify for benefits for a different reason. This program helps approximately 61 million people each year by sending them checks to help them have enough money to use for their living expenses. When you retire, you can collect money from Social Security as well. Your family might also be entitled to collect money from this department if you pass away before you are eligible to begin receiving money from it.

2. Medicare Insurance

Medicare is a health insurance program designed primarily for people who are retired or elderly. The money you contribute out of each paycheck goes to help these individuals receive the medical care they need and access to the prescriptions they require. Approximately 15% of the population in the U.S. currently receives benefits from Medicare.

You cannot opt-out of Social Security benefits or Medicare as a way of avoiding these deductions. You have to pay them if you are working. You can opt-out of receiving the benefits they offer, though. If you retire and have plenty of money saved up, then you are not obliged to use these benefits. In fact, you must apply to use them in that case.

Regardless of your choice, you are required to pay FICA taxes throughout your entire working career.

The Rates You Pay For FICA

FICA taxes are designated for the two programs listed above, and that is why you will see two different deductions on your pay stubs. Still wondering what FICA is on my pasystub and why it is there? The FICA taxes you pay for Social Security are equal to 6.2% of your gross earnings each pay period. You will pay this tax on all your earnings up to $137,700. When you reach this amount of money earned, you no longer pay this tax.

The FICA taxes for Medicare are equal to 1.45% of your gross earnings. There is no cap on earnings for Medicare taxes. You will pay the rate on all earnings, and you will actually pay a higher rate if you earn a lot of money. For single people who earn over $200,000 and for married people who earn over $250,000, there are additional fees for Medicare taxes.

The one thing you might not realize about FICA taxes on my paystub is that your employer is legally required to match the amounts that you pay. Therefore, your employer also pays 6.2% for Social Security and 1.45% for Medicare. Each time you receive a paycheck, your employer withholds the necessary amounts for your portion of FICA taxes. When the employer pays these to the government, they also add in their portion.

So the amount you are actually contributing to both programs is double what you see withheld from your checks. Still worried about what is FICA on my paystub? It doesn't look so bad after all.

The Effects Of Self-Employment For FICA Taxes

1. Self-Employment Changes Everything

When you're self-employed, FICA taxes work differently. You'll pay double the normal rate because you cover both the employee and employer portions. That means 12.4% for Social Security instead of 6.2%, and 2.9% for Medicare instead of 1.45%.

2. Start Paying Yourself Regularly

If you're self-employed, consider giving yourself regular paychecks using a paystub maker. This creates a simple way to track your earnings and withhold taxes consistently. Without regular tax withholding, you could face a massive tax bill at year-end.

3. Avoid Costly Penalties

The IRS requires self-employed individuals to pay taxes quarterly. Missing these payments can result in penalty fees on top of what you already owe. Paying taxes regularly is easier on your budget and keeps you penalty-free.RetryClaude can make mistakes. Please double-check responses.

Take Control of Your Paycheck Today

Now that you understand what FICA means on your paystub, you're one step closer to financial clarity. Knowledge is power. The more you understand about your deductions, the better you can plan your budget and protect yourself from financial surprises.

Ready to Create Professional Paystubs? Create Your Paystubs Online Now

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!