What Is A Pay Stub And Why Is It Important?

By Jaden Miller , August 21 2019

Ever wondered what is a paystub? Why is it important? Here's the back story. Many Americans are working from home, now more than ever, while some others are still going to their jobs. Life is full of ups and downs job losses and job gains, freelancing or full time. What do all of these economic indicators mean? For starters, it proves that people are earning money and depositing pay stubs. So what are paystubs?

The majority of employees get paid through direct deposit while others get paid in check but the bottom line is, we all need proof of income for various perks in life. What makes paystubs important? Read on to find out what is a paystub and why is it important.

What Is A Paystub?

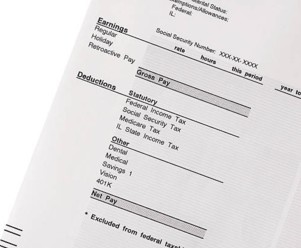

If you're wondering, what is a paystub, look no further! A paystub has many names among which are payslip, pay stub, paycheck stub, or checkstub. It is a document that lists and itemizes your salary for a specific period of time. A Paystub document lists your taxes and deductions taken out of your paycheck. An employee is given a paystub by his/her employer. If an individual does not receive a paycheck stub, you can easily create one using a paystub generator.

Why Is A Pay Stub Important?

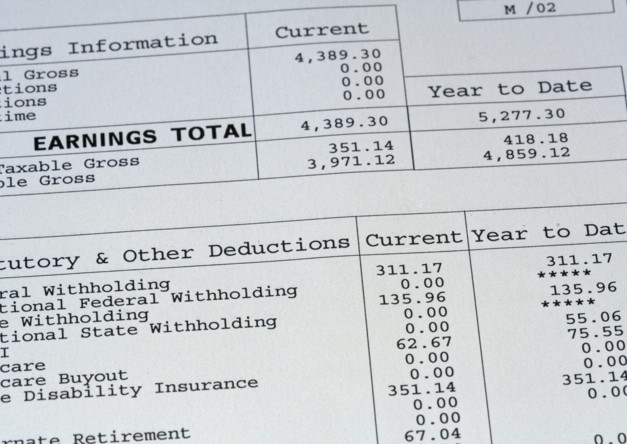

Now that you've understood what is a paystub, let's dive in to understand its importance in. our daily lives. Your paystub is critical to your personal finances. This is how you manage your weekly or biweekly budget. The pay stub reveals your gross earnings during the pay period. This is your hourly rate multiplied by the number of hours you worked.

From here, there are a number of deductions that lead to your take-home pay. Your pay stub automatically takes out money for things like taxes or insurance. It also tells you other important information. This includes items like paid time off or annual retirement contributions.

What Are Deductions?

The amount of money deposited into your bank account is not the same as your gross pay. This is because there are various deductions made to your earnings. Some deductions are employee benefits, while others are government programs. Your pay stub is important because it informs you how much is contributed towards benefit programs.

For instance, you will learn how much is taken from each paycheck for health insurance. Any other type of insurance that you carry is deducted from your earnings. This includes dental, vision, and life insurance. Other major deductions are federal and state income taxes. The federal government deducts a portion of your paycheck for Social Security and Medicare entitlements.

Furthermore, your state of residency automatically deducts more money. The rate varies but goes towards programs like unemployment and disability insurance. Read on to extend your knowledge about what is a paystub and what it entails.

What Other Information Is Included On A Pay Stub?

Financial information is just the tip of the iceberg of what is a paystub. There are other important details included on a pay stub as well. One great example is your paid time off (PTO). Each company handles PTO differently. Some break it out between sick and vacation time. Pay stubs often provide a summary of how much PTO you have remaining.

Another important detail on your pay stub is the number of federal withholdings you are claiming. This is related to your federal income tax deduction. The number of withholdings changes the amount that your employer holds back for taxes. Check out these 5 key ways to read a paystub like a pro!

Wrapping It Up

We hope that this gave you an idea of what is a paystub and how you can benefit from it. Your pay stub is one of the most important financial documents that you receive. This is something that you should be checking on a weekly or biweekly basis. Of course, it is a great way to verify that you are being paid the correct amount in gross earnings.

In addition, it is a great way to track items like PTO. Need help creating a pay stub? did you understand all there is to know about what is a paystub?, let's get you started. Simply pick a paystub template out of our gallery to begin creating your paystubs with the paystub generator today!

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!