How To Show Proof of Income If Paid in Cash: Top Income Documents

By Jaden Miller , February 2 2026

To know how to show proof of income if paid in cash, you need to have your income documents. As a business owner or self-employed person, you may sometimes get cash payments. And it can be challenging to prove income.

You may need proof of income for loans, monthly rent, or a financial assistance application. On that note, you can ensure you always have what you need for proof of income with a paystub generator.

In this article, we explain “How can I show proof of income if I get paid cash?” You’ll learn the income documents you need, and how to handle records to keep you on top of your money game.

- What Is Proof of Income?

- How To Show Proof of Income if Paid in Cash

- How To Prove Income if Paid in Cash? Top Income Documents

- How Do I Report Income If I Paid Cash? Tax Filing

- How Can I Show Proof of Income if I Get Paid Cash? Alternative Income Sources

- How Can You Prove You Paid Someone in Cash? Maintaining Financial Records

- In Summary

What Is Proof of Income?

Proof of income means official documentation that can prove your earnings and your employment status. Financial institutions, property managers, and government agencies ask for proof of income. This is to look at your financial situation and check if you can meet financial commitments, pay rent or repay loans.

Examples of common income documents are:

-

pay stubs

-

tax returns

-

bank statements

-

employment verification letters

-

benefit statements.

For salaried employees, they can use a few recent pay stubs. However, this changes when you get cash payments as a self-employed individual or as a business owner. This makes the independent contractor proof of income verification process more difficult.

You need other income documents to prove income and show that you have consistent earnings. Financial institutions and property managers require proof to verify income. It allows them to assess financial stability and prevent fraud.

Read more: How To Get Pay Stubs From Previous Employer

How To Show Proof of Income if Paid in Cash

When you need to know how to prove income if paid in cash, you should focus on having proper income documentation. That’s what financial institutions and property managers accept. Income documents give reliable proof of cash earnings and show financial stability. You need to have bank statements showing consistent deposits, tax returns, and many more. These methods can help you verify income even without traditional pay stubs.

Also check: Create pay stubs online with our easy-to-use paystub maker tool

How To Prove Income if Paid in Cash? Top Income Documents

How to show proof of income if paid in cash? Here are the best income documents and methods to prove income when paid in cash:

1. Bank Statements and Bank Account Records

Bank statements are great income documents for anyone paid in cash. You deposit cash payments into your bank account. Then, bank statements create records of consistent deposits that verify income. Some financial institutions and property managers accept bank statements. Since they show regular payments, some take them as valid proof.

Bank statements show financial stability through bank deposits, transaction history, and spending habits. Ask for statements covering three to six months to show consistent earnings. Bank statements work well for self-employed individuals and business owners. This is because they get cash payments from multiple income sources. They show financial health and compliance through consistent deposits.

2. Tax Returns for Income Verification

Tax returns are official documents that are very valuable. Government agencies and financial institutions take them for income verification. When you file taxes with your cash earnings, your tax returns are now legally valid proof of income. Tax documents show annual income, gross income, and employment status.

For self-employed individuals, their tax filings will have the Schedule C section. In this part, they show their business income and expenses. These break down your self-employment income and provide comprehensive income documentation. Tax returns cover a full year, giving a complete picture of your financial situation.

3. Employment Verification Letter or Income Letter

An employment verification letter or income letter from your employer or clients is another option. It serves as official documentation of earnings. This formal document should include job title, hourly wage or salary, the dates you worked there, and average income. For self-employed workers, an income letter from regular clients works just fine. It should describe the services rendered and payment amounts to verify income.

4. Profit and Loss Statements for Income Proof

Profit and loss statements are essential business financial statements. Self-employed individuals and business owners are quite familiar with this. These financial records show income sources, expenses, and net profit, and that’s enough income proof.

To prepare profit and loss statements, you have to track all cash payments and business expenses. These documents show gross income, expenses, and net income. That gives financial institutions detailed income documentation.

5. Receipts and Additional Income Documents

You can get a clear picture of your earnings by making receipts for cash payments. Then, issue receipts for services rendered to have a paper trail of cash earnings. Receipts should include date, amount, services rendered, payer information, and business details. Organized receipts can help with your tax returns, profit and loss statements, and bank statements.

6. Spreadsheets and Tracking Cash Payments

You can put together detailed spreadsheets of cash payments as another option. This allows you to have proper income documentation. Note the date of payment, the amount, who paid and what they paid for. This ledger serves as a financial record supporting other income documents. Though it’s not official documentation in itself, it supports your income verification process. This provides organized data explaining bank deposits and cash earnings patterns.

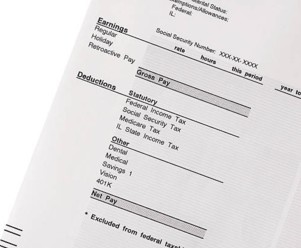

7. Make Your Own Paystubs

If you get cash payments, you can make your own pay stubs using online generators. Simply enter your cash earnings, hours worked, and deductions. This is a common way for self-employed people or business owners to create official documentation. And it looks just like a standard employer stub. You may, however, need to back them up with other documents.

Also Read: Why Is a Self-Employed Pay Stub Important?

How Do I Report Income If I Paid Cash? Tax Filing

Apart from how to prove income if paid in cash, you also have to file taxes. You must report all your cash earnings on tax returns. Self-employed individuals have to report income on Schedule C. But those paid cash by an employer should receive W-2 forms.

Filing accurate tax returns creates official documents for income verification. Government agencies and financial institutions rely on tax documents because they're legally valid. Failing to report cash earnings leaves you without proof of income when you need it. And you may need them for financial assistance and child support. It may also come up for unemployment benefits or Social Security benefits.

How Can I Show Proof of Income if I Get Paid Cash? Alternative Income Sources

If your income comes from certain income sources, you can still show proof of income. So, here’s how to prove income when paid cash for those ones:

1. Additional Income Sources and Driver's License Verification

Self-employed workers have some additional options. Business contracts showing regular payments and invoices for services rendered help verify income. Bank deposit slips provide transaction-level proof, complementing bank statements. While not direct proof of income, credit reports show financial stability and payment history.

2. Using Benefit Statements as Income Proof

There are occasions when you do not make money only through a job. Beyond earned income, benefit statements serve as proof of income. You may get unemployment benefits, disability payments, Social Security benefits, or housing subsidies. In such cases, benefit letters or statements from government agencies can provide official documentation.

Further reading: Where To Find HSA Contributions on W2 and Other Tax Forms

How Can You Prove You Paid Someone in Cash? Maintaining Financial Records

Now, we know how to prove income when paid cash. But how can you prove you paid someone in cash? You need to manage your records. If you're an employer paying others in cash, create written payment records and have recipients sign receipts. This documentation can prove payment and help recipients verify income.

To ensure you have proof of income when you are paid in cash, always deposit cash payments into your bank account. Keep detailed records of income sources and file your tax returns accurately. These practices can ensure that you have reliable proof. So whenever you need valid proof, you get legally valid income documentation whenever you need it.

Check out: Use our pay stub templates to create documents quickly

In Summary

We can assume that you know how to show proof of income if paid in cash. You may be freelancing or own a business. Either way, you can put together income documents to show that you can afford things like paying rent or repaying loans. This way, you have official documentation as valid proof of income when you need it.

One way for how to prove income when paid cash is to create pay stubs that show what you earn. That’s where our pay stub maker can help you out. Our tool can create professional pay stubs for your financial needs in minutes.

Frequently Asked Questions

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!