Why Is a Self Employed Pay Stub Important?

By Jaden Miller , September 4 2025

Now, more people are choosing to work for themselves. This has made freelancing, contracting, and self-employment a major part of the global economy.

They allow you to control your schedule. You can also build your business on your own terms. However, as a self-employed individual, you might face certain challenges when it comes to managing your finances.

You usually don't have an employer or payroll team that creates your pay records and sends them to you, unlike employees. This can be quite an issue as a self-employed individual when you need proof of income.

This is why your self employed pay stubs are necessary. This article, therefore, explains what a self-employed pay stub is. You’ll also understand why it's important.

What Is a Pay Stub?

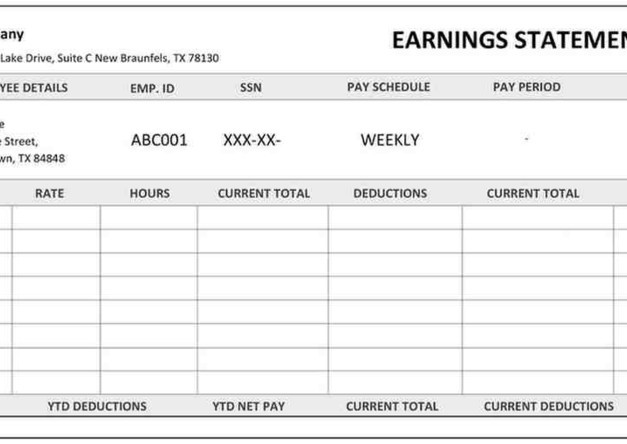

A pay stub is a document showing the breakdown of your earnings and the deductions taken from them. Its purpose is to record how much money you made over a period and show where it went.

Employers give regular employees pay stubs every payday. For self-employment, things are pretty different. Since no employer handles your payroll or deducts taxes, you must create your paystub on your own. A pay stub for self employed doesn't include tax withholdings or employer benefits; it just shows the income you've earned.

Why Do Self-Employed Individuals Need Pay Stubs?

Keeping a self employed pay stub is very important when you work for yourself. Here's why you need your pay document as a self-employed individual:

-

Proof of Income: One of the most important reasons for having pay stubs is to show proof of income. Lenders need to know that you have a steady flow of income if you're applying for a loan or mortgage. This can also be when financing a car.

-

Rental Applications: Landlords usually ask for pay stubs before approving a rental application. This helps them confirm that you can afford to pay their monthly rent and be consistent. Being self-employed and having your pay stubs ready already helps you save time. This makes the process easier, so you don't have to start gathering your bank statements or invoices.

-

Tax Compliance: Filing your taxes as a self-employed person can be complicated sometimes. Pay stubs help track how much you're earning and what expenses you're deducting. They also help to determine how much you should be putting aside for your estimated taxes. Having everything broken down on a stub makes tax season less stressful. It also allows you to reduce the risk of errors.

-

Government Programs and Subsidies: If you're applying for government aid, grants, or subsidies, one of the requirements is usually proof of net income. Your pay stub has this exactly, and it helps you qualify for these programs that may not be easy to access.

-

Legal and Contractual Purposes: Pay stubs can also serve as important legal documents. They can be used in child support cases, divorce settlements, or even in certain business agreements. All of these are cases where you need to show a clear financial record.

-

Professionalism and Credibility: Lastly, having pay stubs adds professionalism to your work. When dealing with clients, business partners, or even investors, this already shows that you maintain organized financial records. This helps to build trust and credibility.

How To Make a Pay Stub as a Self-Employed Individual

Making a pay stub for self-employment may not seem necessary, but it’s important. Here are some practical ways to get it done:

-

Pay Stub Generators

The fastest option is to use an online pay stub generator. These tools let you enter your business name, income and deductions. It then creates a professional stub you can download instantly.

-

Accounting Software

If you already use certain software to manage your business, you can generate pay stubs directly from it. These platforms automatically track your income and expenses, making creating accurate records easier without extra work.

-

DIY Approach

If you prefer full control spreadsheets, like Excel or Google Sheets, these work just fine. You can set up a simple self employed pay stub template that includes income, deductions, and net pay. While it takes more time, it's free and flexible to your needs.

-

Payroll Services

You can hire a payroll service if you want another, more stress-free option. These professionals manage everything. This includes your calculations, taxes, and official documentation. Although this is more expensive, it is still easier.

Information Included in a Self Employed Pay Stub

The US self-employed pay stub requirements mandate that your pay stub must have the following information:

-

Personal Details

Every pay stub should start with basic personal information. This includes your full name and home address. These details identify that you're receiving payment. It then makes the document valid when you use it for official or financial purposes.

-

Business Information

For self-employed individuals, including your business details adds credibility. This means your registered business name, business address, and Employer Identification Number (EIN), if you have one. It shows that your income is definitely not a scam.

-

Pay Period and Payment Date

A pay stub self employed document should clearly show the period of work you cover, for example, weekly, bi-weekly, or monthly. It should also show the exact date your payment was issued. This helps create a timeline of earnings and keeps financial records organized.

-

Income Details

It includes the breakdown of your income: your gross pay, which is your total income before any deductions. It also shows any extras like your tips, commissions or bonuses.

-

Deductions and Business Expenses

You also need to record items like your business costs and health insurance premiums, and show your retirement contributions. These deductions allow you to understand your actual take-home pay.

-

Taxes

Unlike regular employees, self-employed individuals are supposed to handle their own tax obligations. Therefore, your self employed pay stub would have your federal, state, Social Security, Medicare and self-employment taxes. This makes it easier for you to file your taxes and keep your financial records accurate.

-

Net Pay

After all your deductions and taxes have been accounted for, the remaining amount is your net pay. This is the actual income you can use and is often the figure requested for loans, rentals or financial applications.

YTD figures show your cumulative earnings and deductions throughout the year. They're useful for tracking and preparing taxes.

Issues With Not Having Your Self Employed Pay Stubs

It can be risky when you don't have your pay stub. This is why you need your own self employed pay stub:

-

Bank Statements or Invoices May Not Be Enough: While many self-employed individuals use their invoices or bank statements to show earnings, these documents are not enough. They usually don't always satisfy lenders, landlords or institutions. They may not clearly highlight your consistent income or a regular payment schedule.

-

Income Fluctuations: Being self-employed often means that your income isn't the same every month. Presenting a steady earning history becomes difficult when you don't have your pay stubs.

-

Risk of Rejections for Loans or Rentals: Getting a loan, mortgage, or apartment rental can be difficult without pay stubs. Banks and landlords will view your lack of proper proof of income as a risk. This could then lead to delays, or they might simply reject your application.

-

Loss of Professional Credibility: Giving out handwritten notes, invoices, or informal records makes you appear unprofessional. This issue can impact loan approvals. It also affects business deals, partnerships, and other formal agreements.

Final Thoughts

As a self-employed individual, creating your pay stubs is about having proper control over your finances. They help to separate your personal and business money. Ultimately, this makes your finances more manageable. Having proper pay stubs also makes your business more professional. It shows banks, clients, and even future partners that you take your work seriously. At the end of the day, being self-employed means you're both the boss and the employee. Treating your finances with that same discipline gives you more stability and credibility.

Managing your finances as a freelancer or small business owner doesn't need to feel tiring at all. With our Paystub Generator, you can create accurate and professional paystubs. This way, you can always stay organized, prepare for taxes, and show proof of income when needed. Visit us today!Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!