Do Pay Stubs Have Social Security Number?

By Davis Clarkson , February 1 2026

The answer to “Do pay stubs have Social Security number?” is yes, but how it shows up on your pay stub may be different. When employees go through their paychecks, they have questions like this one. You need to know whether your pay stubs with Social Security number show your full SSN.

This is important to protect your identity and ensure proper record-keeping. If you need pay stubs with correct details, you can make your pay stubs with a reliable paystub generator.

In this article, we answer “Do pay stubs show Social Security number?” This is to help you understand what sensitive information shows up on your pay statement. You’ll also learn whether your pay stub shows your full SSN and find out other details on your pay stub.

- Do Pay Stubs Have Social Security Number? SSN Requirements

- What Is a Pay Stub With Social Security Number (SSN)?

- What Information Appears on Pay Stub With Social Security Number?

- Do Pay Stubs Have SSN? Paycheck Stubs and Pay Statement Requirements

- Does Pay Stub With Full SSN Have Identity Theft Risks?

- Final Thoughts on Do Paystubs Have SSN

Do Pay Stubs Have Social Security Number? SSN Requirements

Do pay stubs have Social Security number? Yes, many pay stubs have your Social Security number or a part of it. Your employer needs to report wages to the Social Security Administration and take out federal taxes and state taxes. To do this, they need the employee’s Social Security number.

Not every pay stub, however, shows full Social Security numbers. Many states have made laws to protect against identity theft. They require employers to reduce sensitive information on pay stubs. Some state laws require employers to show only the last four digits and not the whole nine-digit number. This prevents identity theft while giving enough information for record-keeping.

Read more: Using Your Pay Stub for Tax Filing

What Is a Pay Stub With Social Security Number (SSN)?

Your Social Security Number SSN is a nine-digit number that uniquely identifies you. You’ll need it for tax purposes, Social Security benefits, and employment verification.

The security number on your pay stub serves a number of reasons. It helps employers track earnings and deductions during each pay period. The Social Security Administration requires employers to report wages using the employee’s SSN. It also helps to calculate their future Social Security benefits. Your SSN also makes sure federal and state tax withholdings are duly credited to tax returns.

Also read: OASDI Meaning: What Is OASDI Tax on Paycheck?

What Information Appears on Pay Stub With Social Security Number?

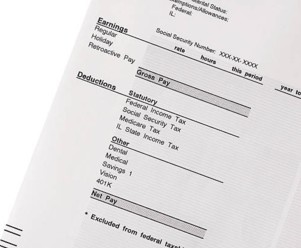

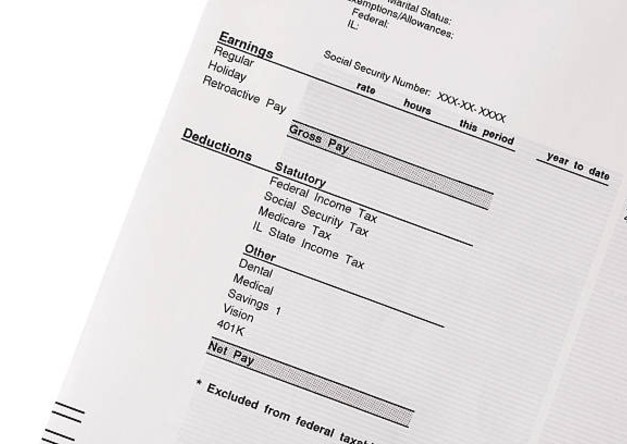

A typical pay stub with Social Security number does not only include your SSN. You should understand all the information on your pay statement to be sure your payment is correct.

-

Personal and General Information

Your pay stub has several identifiers that verify your identity and employment. It has your full name and current mailing address. Many employers also put a unique employee identification number (EIN) for their internal tracking. Your individual employee ID is distinct from the business's federal employer identification number. However, both may appear on the statement.

-

Employee's SSN or Last Four Digits

Your pay stub has the employee’s Social Security number, whether it’s the full SSN or the last four digits. Not that the employee identification number that the company uses is different from your SSN.

-

Pay Period Dates and Hours Worked

Each pay stub you get has pay period dates, and that covers when you worked and earned wages. For hourly employees, you’ll see your hours worked, and this breaks down your regular and overtime hours. Then, you’ll see the pay rates for each type, and this helps you understand how the gross pay is calculated.

-

Net Pay and Gross Pay

Your gross pay shows all your total earnings before deductions are taken out. Your net pay is the total amount you get after all deductions are applied. The latter is what gets to your bank account.

-

Taxes and Other Deductions

This is the section of the pay stub that explains the difference between what you earned and your net pay. Those deductions include Federal taxes, Social Security taxes, Medicare taxes, and FICA taxes. Other deductions like health insurance, retirement, or wage garnishments are also listed.

Check out: Create paystubs instantly with our pay stub templates

Do Pay Stubs Have SSN? Paycheck Stubs and Pay Statement Requirements

Whether your pay stubs have your Social Security number depends on where you work. Federal law doesn’t specifically require that employers put Social Security numbers on pay stubs. However, it demands some wage documentation. State laws usually have more specific requirements for compliant pay stubs.

California Labor Code Requirements

California labor code gives us a good example of such requirements. California state laws require employers to give written statements to employees. The statement documents details of earnings and deductions for each pay period.

However, California doesn't mandate showing employees' Social Security numbers on pay stubs. But many California employers display at least the last four digits to identify the employee.

Other states

Rules can be different across states. Some explicitly require employers to mask Social Security numbers. So, they show only the last four digits to protect against identity theft. Other states leave it to the discretion of the employer.

However, employers should not fail to provide pay stubs where it’s required. They should also comply with state laws about sensitive information protection, or they may face penalties. Non-compliance can result in fines and even legal action.

Further reading: Pay Stub Laws: What Employers Must Provide by State

Does Pay Stub With Full SSN Have Identity Theft Risks?

Having a pay stub with full SSN creates identity theft risks. Your Social Security number is very valuable identity information. You use it to open bank accounts, apply to get credit, and even to access tax information. If full Social Security numbers are on pay stubs, they can be vulnerable to theft. This risk can even increase when they’re email pay stubs that are sent electronically.

A pay stub with SSN, your name, address, and employer details can give criminals everything. They may be able to use it to file fraudulent tax returns, open credit accounts, or even steal your Social Security benefits. Protect pay stubs by physically storing paycheck stubs in a safe place and destroying old ones. Use a password-protected, secure email for email pay stubs.

Check credit reports regularly for any unauthorized activity, which is a sign of identity theft. Watch your Social Security earnings record through the Social Security Administration website. That way, you can be sure that only legitimate wages are being reported with your Social Security number.

Check out: Make pay stubs effortlessly with our paystub generator

Final Thoughts on Do Paystubs Have SSN

Now, you know the answer to do pay stubs have Social Security number. And that’s yes, most pay stubs include your Social Security number, either your full Social Security number or the last four digits. You should always take extra care with your payroll records to ensure that sensitive information doesn’t get into the wrong hands.

You need pay stubs with SSN and other essential information in a lot of official situations. Our paystub creator can help you create professional paystubs with all the details you need. Try it out today, and you never have to worry about missing information on your pay stubs.

Frequently Asked Questions

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!