The Ultimate Guide To Property Tax Deduction

By Jaden Miller , September 21 2021

Let’s be honest, no one likes paying real estate taxes. Especially not when you live in an area where real estate taxes are high. However, there’s a silver lining here and it’s called property tax deduction, which can reduce the amount of taxes you pay. The IRS provides all the homeowners’ tax information you need to understand how everything works. In today’s guide, we will provide a summary to make things easier for you and help you understand who claims property tax deduction and what it is so you can benefit from it.

As with almost everything that has to do with taxes, property tax deduction can be complex, but it’s not difficult to understand when you have the right resources. We’ll provide some of that today and help you determine if you can take advantage of this tax deduction. Before we get started if you need help setting up a tax payment plan with the IRS, this guide is exactly what you’re looking for. God knows everyone needs a little help with taxes, especially if you’re doing it on your own.

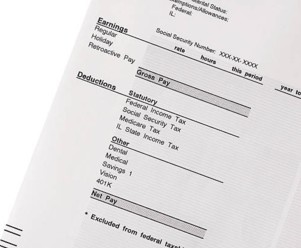

If you need to create paystubs for your business, be sure to check out the paystub generator.

An Introduction To Property Tax Deduction

When you’re a homeowner, property taxes on a state and local level can be deducted from your federal income taxes. This tax deduction doesn’t include taxes on renovations or services such as trash collection, but we’ll get to what you can and can’t deduct later on. It’s important to note that the Tax Cuts and Jobs Act put a cap on this kind of deduction, which stands at $10,000 or $5,000 if you’re married but you file your taxes separately. That’s the property tax deduction limit 2020. Before this law, property tax deduction didn’t have a limit.

This has many people comparing property tax deduction single vs married. Now, it’s obvious that single people benefit more from property tax deductions because they don’t have to split the limit amount with their spouse. However, if you file you are married and you file your taxes together instead of separately, you can take advantage of the limit together instead of splitting it. At the end of the day, there’s a lot to consider when it comes to property tax deduction single vs married.

One of the main questions people ask about property tax deduction is: who claims property tax deduction? The answer is homeowners who itemize their tax returns. But before we get into all that, let’s establish what property tax deduction is. As a homeowner, you already know you have to pay taxes on your property which are assessed every year by the state or local government based on its value. You can benefit from a tax reduction on a part or all the property taxes you paid.

Now, a tax deduction allows you to reduce your taxable income and lower your tax liability as well. By subtracting the amount of tax deduction from your income, your taxable income becomes lower, which means your tax bill will also be reduced. One important thing about property tax deduction is that real estate taxes are deductible in the year you pay them, not the year where they were assessed. So, let’s say your property taxes were billed in October 2019. That means the real tax deduction will happen on your 2020 tax return.

Special Considerations About Property Tax Deduction

There are some special considerations you need to know about when it comes to property tax deductions. For one, you can’t deduct taxes you’ve paid on commercial or rental property. Also, there are miscellaneous items that you can’t deduct. For example, if you pay to make improvements in your local residential area or pay for service delivery, you won’t be able to deduct that. To understand special considerations much further, we encourage you to read Form 1098.

Also, if you bought a home and you paid your seller’s delinquent taxes when you closed the sale, you won’t be able to deduct those tax payments. Why? Because it’s bundled together with the cost of purchasing the home.

What Can Be Deducted?

As mentioned earlier, you can deduct up to $10,000 or $5,000 if you’re married but you file your taxes separately, which is the property tax deduction limit 2020. You might be able to deduct property taxes you on:

-

Your primary home.

-

A co-op apartment.

-

Your vacation or secondary home.

-

Your land.

-

The property you own outside of the US.

-

Cars, RVs, and other kinds of vehicles.

-

Boats.

Property tax deduction includes the taxes you pay for owning your primary home, and also a secondary home or even land that you still haven’t developed. It won’t allow you to deduct property taxes on investment property, though, but you can deduct that differently.

What Can’t Be Deducted?

Of course, not everything can be deducted and you must be aware of the things that can’t be deducted. The IRS doesn’t allow homeowners property tax deductions for certain things, including:

-

Property taxes on properties that are not yours.

-

Property taxes that haven’t been paid yet.

-

Assessments for sidewalks, water systems, sewer systems, and building streets in the neighborhood you live in.

-

Services such as water, gas, or trash collection are not deductible.

-

Transfer taxes on the closing of the home because they are considered a part of the cost of the home.

-

Assessments performed by a homeowners association.

-

Lone payments used to finance energy-saving improvements done to the home are not deductible either.

Claiming Property Tax Deduction

Now that you have a better understanding of this kind of deduction and what you can and can’t deduct, it’s important you get familiar with the process of claiming it. It’s not difficult, but you will have to get a few things in order.

1. Get Your Tax Records In Order

Your tax records are essential for claiming your property tax deduction, so you need to make sure you have everything. Your local taxing authority can provide a copy of your home’s tax bill. You also need to make sure you have all the registration paperwork for your movable assets, meaning your car, boat, RV, etc. Why? Because you might also be paying property taxes on those assets and it can be deducted.

2. Exclude Everything That’s Not Deductible

You can only deduct property tax if it’s uniformly assessed at a rate that’s similar to similar property in the community you live in. In other words, the proceeds help the community, they don’t pay for a special service or privilege for you. In some counties, assessments for improvements are made, but they may not be deducted if they are not a tax.

3. Use Schedule A To File Your Return

Schedule A is where you list your itemized deductions. As mentioned before, property tax deduction requires itemization, so you won’t be able to take the standard deduction. When you itemize your taxes, it makes doing your taxes a bit more time-consuming than you would like. However, it helps you get a lower tax bill so it’s definitely worth the effort.

Your itemized deductions are listed in Schedule A and then this is attached to Form 1040. This is where it’s important to remember that property taxes and income or sales taxes are all bundled together. The sum of everything can’t surpass $10,000 or $5,000 if you’re married and filing taxes separately because that’s the limit after the Tax Cuts and Jobs Act. This is why itemizing is the least attractive option for most. However, it’s a must if you want to enjoy property tax deduction so you have to decide if that’s the right move for you or not.

4. Property Tax Deduction In The Year You Pay Your Taxes

As we already mentioned in earlier sections, property taxes are deducted in the year you pay your taxes, not the year they were assessed. This sounds simple, but it can be a bit complicated. When it comes to paying property taxes on a house, you have two options. You can write a check once or twice a year when you get the bill or you can set money aside every month each time you pay your mortgage. Don’t let the second option fool you, though. You want to deduct only the taxes you have actually paid during the year, nothing more.

Itemizing Your Taxes For Property Tax Deduction

It’s clear by now that to deduct property taxes or any kind of personal property taxes, it’s necessary to itemize deductions on your taxes. Itemized deductions are expenses that can be subtracted from your AGI (adjusted gross income) and it will reduce your taxable income, which means you’ll pay fewer taxes. A standard deduction on the other hand is a fixed dollar amount that only varies depending on filing status.

Itemized deductions need to be listed on Schedule A of Form 1040. This is why keeping records is so important because you’ll need receipts to show the IRS in case you’re audited. There is other proof of expenses, such as bank statements. There are two main options when it comes to deductions on your tax return. You can itemize them, which means you have to list each deduction you’re entitled to and subtract them from your taxable income.

The other option is the standard deduction, which will also reduce your taxable income. Choosing between those two options is easy because you just have to go for the one that’s best for you. When your itemized deductions are greater than the standard deduction, it’s in your best interest to do the extra work and itemize deductions. If that’s not the case, the standard deduction will be the best option for you.

The truth is that after the Tax Cuts and Jobs Act was introduced, itemizing deductions became the less attractive option for most people because the standard deduction was greatly increased. However, it’s a must for homeowners who want to claim property tax deduction. That means that you have a choice to make. You have to decide if claiming property tax deduction is the best move because you have to itemize. If you decide that you want to go ahead and do that, it’s important to know what you can and can’t itemize.

So, let’s go over a quick way of itemizing deductions. The first thing you need to do is add up the itemized deductions you can claim from this list:

-

Mortgage interest on up to $750,000 in principal.

-

Medical expenses that are greater than 10% of your AGI.

-

Charitable contributions.

-

State and local income and property tax up to $10,000.

Once you add that up, compare them to the applicable standard deduction. Here are the deductions you won’t be able to itemize:

-

Mortgage interest on loans of over $750,000, unless you purchased your home before December 16, 2017.

-

State and local income, personal property, and sales taxes that surpass $10,000.

-

Unreimbursed employee expenses.

-

Expenses relating to tax preparation.

-

Natural disaster losses.

How To Maximize Your Property Tax Deduction

If you want to get a bigger property tax deduction, there are a few things you can do. For one, you can prepay your property taxes. Let’s say your semiannual tax bill is due next year. You could wait to pay it then, but if you pay early, you will be able to deduct that on this year’s taxes. There comes a time when you have to renew your vehicle’s registration. Well, you want to hold onto the registration statements because there’s a possibility a part of the fee will count as property tax and that could be deducted.

If you purchased or sold a home, you need to look at the closing paperwork very closely. Check what you paid at closing for property taxes because that’s very easy to overlook. Not to mention that once the tax assessor can revalue the property, you might receive a second tax bill. As you can see, there’s a lot that goes into property tax deduction but it can be worth your while!

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!