How Do I Set Up A Tax Payment Plan With The IRS?

By Jaden Miller , January 16 2021

If you are among the 84 percent of Americans who file and pay their taxes on time every year, you may not even know that IRS tax payment plan options exist. As tax law continues to become more complex, however, an increasing percentage of Americans are struggling to file and pay their taxes on time. But what exactly is an IRS tax payment plan?

How do I set up a payment plan with the IRS? How do I set up payments to the IRS if I can't afford to pay at all right now? Here are the facts every taxpayer should know.

Step 1: File Your Taxes

Before you can ask questions like "how do I set up payments to the IRS?" you need to address more basic tasks. You can't know how much you need to pay the IRS, much less look at how to set up tax payments, until you've filed your taxes. You also are not eligible for any form of IRS tax payment plan unless or until you have filed your taxes.

So if you have questions about payment plan options, start by filing your taxes. It is important to file on time even if you cannot pay at that time. Late filing can:

- Make it more difficult to qualify for a payment plan

- Add fines and fees to your plan, making it more expensive

- Give you less time to make payments on your plan and get caught up before the next year's taxes are due

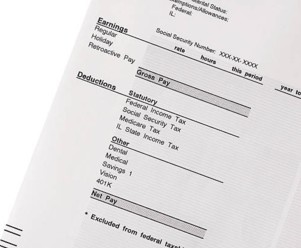

If you are struggling to file, an expert tax preparer can assist you. Be sure to provide them will all appropriate documents, including your W-2s, in advance.

Step 2: Determine What Plans You Qualify For

Taxpayers asking "how do I set up a payment plan with the IRS?" often are not aware that there is more than one type of payment plan available. Understanding the different types and who qualifies for them is a key first step to applying. It is important to note that nearly all plans include interest charges and late fees and that these must be taken into account when planning repayment terms.

Guaranteed Installment Plans

Guaranteed installment plans are available to taxpayers who:

- Owe $10,000 or less

- Have filed and paid their taxes on time (or within an approved extension) for at least five years prior to seeking a plan

- Agree to file and pay on time in the future

- Agree to repay the amount owed in three years or less

- Are not in the middle of applying for bankruptcy

If you accept and abide by a GI plan, the IRS will not file any liens or levies against you. This protects your assets and credit score and makes managing your finances easier.

Individual Payment Plans

Individual payment plans are available to taxpayers who:

- Owe the IRS over $10,000

- Have filed their tax returns on time (or within an approved extension)

- Agree to file and pay on time in the future

Depending on the total amount you owe, you may qualify for a short-term repayment plan of fewer than 120 days or a long-term plan.

Partial Payment Installment Plan

Partial payment installment agreements (PPIAs) may be an option for taxpayers with extremely limited income and assets. Under these plans, the IRS:

- Assesses your proof of income for an apartment renter

- Evaluates your monthly essential living expenses

- Calculates your monthly IRS repayment amount based on the difference between those figures

PPIAs are only available to taxpayers that meet strict income criteria and whose tax filings are up-to-date.

Step 3: Apply for a Tax Payment Plan

Knowing what IRS tax payment plan options are available can still leave taxpayers with questions.

- What if I'm not sure what plan I qualify for?

- How do I set up a payment plan with the IRS that I know I can keep up with?

- Am I guaranteed to get a plan if I apply?

- How do I set up payments to the IRS once I know which plan I want?

Fortunately, the answers to these questions are straightforward. If you have questions about your eligibility, your tax preparer can review your latest filings and assist you in determining which plans you may qualify for. While no taxpayer is guaranteed a payment plan, the IRS is highly motivated to help taxpayers find ways to repay their debts. As such, they rarely reject payment plan applications so long as:

- You apply for a plan for which you qualify

- Your tax filings are up-to-date

- There is no reason why you could not pay the amount in full right away

Applying Online

Many taxpayers wonder "how do I set up a payment plan with the IRS the fastest?" The quickest way to apply for a payment plan is to apply online directly with the IRS. You will need:

- Your name, date of birth, and Social Security Number or Individual Tax ID Number (ITIN)

- A current email address

- Your filing status and the address you used on your latest return

You may also need additional paperwork, such as pay stubs, and personally-identifying information depending on which type of plan you apply for. In many cases, approval is instant and setup is free.

Applying by Mail

A small percentage of taxpayers question "how do I set up payments to the IRS if I don't want to apply online?" If you prefer to file your request by mail, you can complete an IRS Form 9465 instead. For best results, file this form with your tax return. If you file by mail, it will take longer to learn how to pay the IRS the amount you owe.

However, some taxpayers prefer this method because it enables them to have their tax preparer walk them through the process, reducing the likelihood of confusion and errors.

The Secret to Success: Be Proactive

In all cases, the key to paying taxes via a payment plan is to be proactive. If you do not file your returns on time, you cannot take any productive action toward figuring out how to pay the taxes you owe. If you file your returns late, you risk facing heavy fees, fines, and other penalties. These costs can compound over the life of your payment plan, making it harder to keep up your payments and clear your debt.

Filing your taxes on time and talking to your tax preparer about the question "how do I set up payments to the IRS?" when you know you cannot pay everything due right away:

- Maximizes the likelihood of receiving a manageable payment plan

- Protects your credit and assets

- Reduces your stress around taxes

- Keeps you eligible for payment plans and other protective options in the future

While dealing with taxes can be stressful, handling them in an upfront and timely manner always provides the best solutions.

Mastering Financial Management

Setting up a tax payment plan can put you on the road to better financial stability, but it isn't something you want to do every year. Check out our other great articles for more tips on how to take the stress out of taxes this year and every year. Remember to always document your paystub because you will need it as proof of income in the future!

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!