How Does Bi Weekly Payment Affect Taxes? - What to Know

By Jaden Miller , June 15 2023

With the new year comes new taxes. That’s right, it’s that time of year again, one that you either look forward to or loathe having to complete.

Oftentimes, there are particular thoughts swimming around your mix while completing your taxes, such as “how can I make this process easier for next year?”.

One way of looking at this would be by altering the methods you get paid for. Alternatively, you could also consider being paid bi-weekly. However, how would this affect taxes?

This is the type of information you’ll need to know when making modifications to your payment with the HR department.

However, don’t worry, we’re here to help. In this article, we outlined how biweekly payment affects your taxes.

Also read: 5 Valid Reasons For Reporting A Line Manager

What Is Biweekly Payment?

Biweekly payment describes the process of employers paying their employees every other week on a particular day, rather than the standard monthly payments.

For instance, if you’re looking to establish a payment plan that takes a biweekly approach, then you may decide you want your payments every other Friday.

As there are 52 weeks in a calendar year, the result would be a total of 26 paychecks in the year.

Also read: When Is Employee Appreciation Day?

What Are The Benefits Of Biweekly Pay?

Establishing a biweekly payment approach can be beneficial to both HR and employees. We have outlined both below.

For employees, biweekly payments can be advantageous for:

-

Being able to feel more secure in a set payday as opposed to established pay dates which can fall on any day of the week (this goes the same for semi-monthly paychecks).

-

Helping to budget their finances easier is the result of receiving a paycheck on a specific day every other week.

For HR, biweekly payments can be advantageous for:

-

Calculating overtime is easier (as opposed to semi-monthly payments), since a workweek is used to determine overtime.

-

Allows employers to save money if your payroll providers charge you per payroll run (this is if you choose to move towards a weekly payroll schedule).

-

Reduces the chances of any payroll errors and saves time (when compared with the processing of weekly payroll).

What Types of Industries Use Biweekly Pay?

In the U.SOver 36% of businesses pay their employees biweekly. According to the Department of Labor (DOL), the three most common industries that use biweekly payments include:

-

Hospitality and leisure

-

Information

-

Health and education services

Before deciding on how you’re going to pay your employees, you’ll want to visit the DOL and check your specific state’s payday requirements – since some states require paydays at more frequent intervals than others.

Also read: 5 Reasons You Need To Perfect A Job Description

Differences Between Weekly and Biweekly Pay

When it comes to deciding which payment is better: weekly or biweekly, there are a lot of positives and negatives to consider in each payment basis.

When looking at weekly pay, you’re able to move money into the account of your employees much faster. Therefore, your employees don’t have to wait for new funds at the end of the month if they require it straight away.

Even when looking at it in terms of business efficiency, it is much easier to create a flow using weekly paychecks, with pay stubs and paychecks being withdrawn on the same day each week.

That being said, there are a few drawbacks to consider, too. When paying a weekly paycheck, your employers have to pay weekly deposit feeds, too.

Therefore, choosing a biweekly schedule will allow them to save money. Plus, it can also help to prevent potential issues within the accountancy team.

This is important to keep in mind if you’re looking to make a request to the HR department to modify your payment timescales.

Which Is Better for Taxes: Weekly or Biweekly?

Finally, the answer you have been waiting for… when it comes to paying your taxes at the end of the year, which is better: weekly or biweekly?

At the end of the day, the ways in which you get paid aren’t going to affect your taxes, no matter how quickly or long they take.

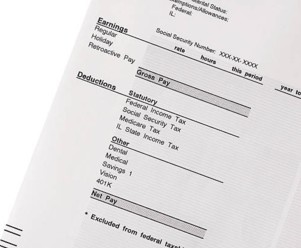

If you take a look at the pay stub that your employer has provided in the form of a pay stub online generator, then you’ll notice that in terms of biweekly paychecks, the withholding is lower when compared to weekly paychecks.

This is simply due to the fact that no matter when you get paid, the amount of taxes withheld will end up being the same amount anyways.

Depending on what kind of payment schedule you are on, the percentage being taken out of your paycheck towards your taxes will be influenced by it. Therefore, ultimately, the ways you’re getting paid will not affect the overall amount you need to pay the IRS.

Therefore, with all this in mind, when looking at payment schedules, we recommend choosing one that suits your personal requirements, rather than one with tax saving purposes.

Also read: Full Time Vs Part Time Hours

What Are The Biweekly Payment Disadvantages?

A biweekly payment schedule is oftentimes a good idea for businesses, especially those containing a mix of salaried and hourly employees.

However, before implementing this payroll schedule, it is important to take a look at all the different angles.

Below, we have outlined some of the drawbacks when it comes to a biweekly pay basis:

-

The company budget needs to account for a three-month period.

-

If the payroll provider charger per payroll run, then the costs can increase.

-

The bookkeeping can become complicated due to two months in the year having three pay terms.

Also read: The Role of HR During Employer Termination

Final Thoughts…

Everyone wants to grab hold of the money quicker, however, is this always the best option in terms of your taxes? Well, you should know that it won’t affect your taxes one bit.

At the end of the day, it doesn’t matter how often you get paid, you’re still required to pay the same tax. Hopefully, this guide has informed you of how biweekly payment affects your taxes.

Get started using our paystub creator today which can create high quality pay stubs in a matter of seconds!

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!