Working 2 Jobs? How Do You File A W-2

By Davis Clarkson , September 30 2020

Confused about how to file two W-2 forms when you've got 2 jobs? This can be a complex task, and unfortunately, can also be one of the greatest stressors we face. We want to make sure we have our tax returns completed accurately and on time. The more income we have and the more sources of income we have, the closer attention we have to pay to our tax returns.

So what happens if you have two jobs and have to file your tax return? You will receive two W-4 forms from each of your employers and will thus, have to file two W-2 forms. This may sound daunting, but it doesn't have to be. In this guide, we will show you how to file your tax return when you are earning income from two jobs and have two w-2 forms from different employers.

Two W-2 From Different Employers

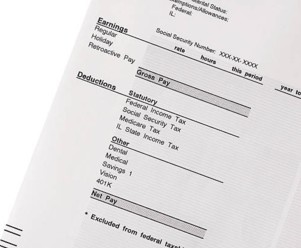

Make sure you always keep records of the money you earn from both of your jobs. Ideally, you should organize these in a spreadsheet - making sure you know your exact income from each job, without mixing the two. If you do not already, you should ask your employers to provide you with a paystub every time you receive your salary. Now, here's what to know when filing your taxes:

1. What Gets Taxed?

While you may only have two full-time jobs, there may be other sources of income that may be taxed. If you have additional sources of income, you must find out if they are taxable before proceeding. If you have any freelancing gigs or "side hustles" they have to be claimed as they are taxable income. If at any time you were unemployed and received unemployment compensation, that, my friend is also taxable.

If you earn income from a rental property or other forms of passive income - such as interest or dividends, you will have to organize this information as you guessed it, it's also taxable. Finally, debt is also taxable unless you have filed for bankruptcy. To play it safe, inform your accountant of all your earnings during the tax year and they will be able to determine what has to be claimed for your tax return.

Doing so can help you minimize errors and efficiently file your forms.

2. Look At Each Form Carefully

Each of your employer's W4 forms will show you how much taxes were withdrawn. When working more than one job, the number of allowances that you can claim has changed - and you must pay attention to this. As a result, you must claim your allowances correctly to avoid paying high taxes. Ideally, the job that pays you more is where you should claim all of your allowances. For the job that pays less, do not claim any allowances.

You must also fill out the Multiple Jobs Worksheet that is found in the W4 form.

3. Social Security Tax

You want to make sure that you do not overpay your social security tax. If in 2019, you earned a total of $128,400 from your total income - you do not have to pay additional social security tax. If, however, you exceed the limit of $8,239.80 from your two jobs, you may qualify for an adjustment. An adjustment is made on Line 71 of Form 1040. Speak to your accountant on how to make an adjustment if applicable.

4. Which Form Do I File?

Most likely, you will use Form 1040 to file your tax return. This is the longest tax form available. There are two shorter tax forms for filing your return: 1040A and 1040EZ. If you are married and are filing jointly, have not exceeded $100,000 in your total income, and are not claiming any dependents (among other requirements) you can use the 1040EZ to file your tax return.

If you do need the option of filing dependent exemptions, you may be eligible for filing the 1040A which has similar requirements to the 1040EZ. This is a longer form, but it is overall shorter than a 1040 Form.

5. Software Or Accountant

You have the option of filing your tax return on your own or using an accountant or tax preparer. If you prefer filing your return on your own, we suggest that you use a tax preparing software program. Programs such as FreshBooks, Hurdlr, or TurboTax can automatically fill in the accurate information. They can also help you with claiming allowances and ensuring you do not overpay your taxes.

Software programs make it much easier than filing by hand. If, however, you do not wish to use a software program you can hire a qualified tax accountant. A tax accountant or tax preparer will be more experienced in filing returns than you likely will. They will also be up to date with the rules so that you do not make any mistakes and, as a software program, they will know the best strategies to help you save money and pay fewer taxes.

6. Be Aware Of The Rules

Finally, we encourage you to also be aware of the rules when filing taxes while working two jobs or more. If you do not file your tax return for both W2's, then you will receive a $50 fine from the IRS. It is imperative that all income from all jobs are included. If you are obliged to pay state and local taxes make sure these are included in your return as well. Again, a software program or a tax preparer is best to help you with this.

If in addition to your two jobs (for which you receive a W2), you may consider freelancing to earn even more income, then you will likely have to pay taxes on this income. You may even be obliged to make quarterly installments. Ideally, you should save up to 30% of your freelancing income to fulfill your tax obligations. You should speak to an accountant beforehand if you plan on freelancing in addition to two jobs.

And of course, if there are any expenses you incur from both or either of your jobs, make sure you keep a record of this. You may be able to write your expenses off and pay fewer taxes even though you are earning additional income from multiple sources.

Prepare Your Returns

Now that you are no longer confused on what to do when you have multiple w2s from different employers, you are now ready to prepare your returns. Make sure you complete them accurately and on time! Be sure to be smart and avoid any unnecessary payments. If you are still confused and want to know more about W-2 forms, we've got the guide for you! And if you need to create a paystub, be sure to check out our paystub generator!

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!