All You Need To Know About Mortgage Interest Tax Deduction

By Jaden Miller , September 5 2021

If you’re wondering how does mortgage interest deduction work? Today’s full guide will help you understand mortgage interest tax deduction. Additionally, it will also show you how you can calculate it and how to claim it when you’re ready. First, you need to understand who gets the mortgage interest tax deduction in the first place, and that’s what this Wall Street Journal article will help you with.

If you qualify and you want to know what you’re getting into, that’s what this guide is for. The mortgage interest tax deduction can be beneficial for some, but there are some cases where it doesn’t make sense to use the deduction. This guide will explain everything so you can determine whether you should or shouldn’t use it and how to use it.

Before we get into the meat and potatoes of today’s guide, we’d like to remind you that you can utilize the super user-friendly pay stub maker that has a helpful blog full of tax resources. These tax resources include living in one state but working in another income tax, financial resources, and much more that will come in very handy.

What Is A Mortgage Interest Tax Deduction?

The mortgage interest tax deduction relates to mortgage interest paid on the first million of mortgage debt. Claiming this kind of deduction requires you to itemize on your tax return. Whether you qualify or not will depend on the amount of your loan and how your taxes are filed. To understand mortgage interest tax deduction better, you have to understand your mortgage payments.

They consist of the principal, which is how much you borrowed, and the interest, which is a percentage of the amount you borrowed and that’s how much it costs you to borrow. Deducting mortgage interest refers to whether homeowners can deduct the total interest they paid in a tax year. That would reduce the total income, which is what is used to calculate the total tax bill.

If you qualify for a mortgage interest tax deduction and you decide to claim it, it means that the total interest you paid on your mortgage will be deducted from the amount of taxes you owe. So, you’ll pay fewer taxes.

Mortgage Interest Tax Deduction in 2021

So, mortgage interest tax deduction will allow you to reduce taxable income by how much you’ve paid in mortgage interest in the year. For this reason, keeping good records is a must because it will help you reduce your tax bill. There are certain mortgage interest tax deduction changes that were introduced by the 2017 Tax Cuts and Jobs Act.

These mortgage interest tax deduction changes doubled the deduction standard and limited or eliminated several itemized deductions. You can claim your mortgage interest tax deduction on the first million of your mortgage debt for a primary or secondary home. If you bought your home after December 15, 2017, you can claim the mortgage interest tax deduction on the first $750,000 of your mortgage.

Here’s a mortgage interest deduction example:

Let’s say that you got a mortgage for $800,000 to purchase a home in 2017 and you paid $25,000 in interest in 2020. That means you can get that $25,000 deducted from your tax return based on this mortgage interest deduction example. However, if you got the same mortgage in 2020, the deduction would be a bit less. Why? Because the 2017 Tax Cuts and Jobs Act limits the deduction to the interest on the first $750,000 of your mortgage.

So, what is it that qualifies you for a mortgage interest tax deduction?

What Qualifies for a Mortgage Interest Tax Deduction?

Not all kinds of mortgage loans qualify for a mortgage interest tax deduction. If you want to know if you can claim it, you need to determine two things:

-

Is your home as collateral for the loan you took out?

-

Is the home your primary residence or your second home?

If you rent out your second home, you can still claim the mortgage tax deduction if you use the home for enough days, which is 14 days or 10% of the time you’re renting it out for. If you don’t rent it out, you can claim the mortgage tax deduction without having to stay in the home. Also, one of the following things needs to be true for you if you want to be eligible for mortgage interest tax deduction:

-

You took out the mortgage before December 16, 2017, and the total debt minus interest is less than a million through 2019.

-

You took out the mortgage after December 16, 2017, and the total debt minus interest equals $750,000 or less through 2019.

If your mortgage debt is greater than the limits just mentioned above, you may be able to claim mortgage interest tax deduction but calculating everything will be a lot more difficult.

What Can Be Deducted?

When you claim a mortgage interest tax deduction, here’s what you can deduct from your taxes:

-

You can deduct late mortgage payment fees if they are not for specific services rendered in connection with the loan.

-

Some lenders charge a penalty if you pay the loan early. That penalty fee can be deducted from your taxes.

-

You can also deduct your mortgage interest in connection to the purchase of a home. That means you can deduct the interest you paid up to the day before closing on the home.

-

Mortgage insurance premiums can also be deducted as long as the contract with your insurer was issued after 2006.

-

Points you paid when you closed on your primary home can be deducted in the same year they were paid. Most points paid on loans for a second home or refinancing can be deducted over the loan’s life.

What Can’t Be Deducted?

Certain costs are not viewed as interest, so they can’t be included in your mortgage interest tax deduction. Here’s what you can’t deduct from your taxes:

-

Ground rent, which is the rent that’s paid specifically for the land, can be deducted from your taxes only in unusual circumstances.

-

Reverse mortgage interest is considered by the IRS to be home equity debt, which can’t be deducted from your taxes.

-

If you are renting with an option to buy, those rent payments won’t be considered interest so they can’t be deducted.

-

Loan placement fees, which are paid by the seller to arrange financing, can’t be deducted as a part of mortgage interest tax deduction.

How To Claim Your Mortgage Interest Tax Deduction

Now that we’ve answered the question “how does mortgage interest deduction work?”, it’s time to talk about how you can claim it if you’ve already established that you qualify for this kind of tax deduction. Here are the steps you need to take:

-

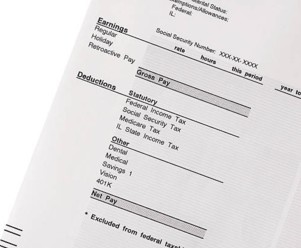

Make Sure You Have the Form 1098

When you take out a mortgage, your lender needs to deliver Form 1098. They have to send it over in January or February, and it details how much your mortgage interest is and the points during the tax year. Your lender will also send a copy of the same form to the IRS, which they use to compare with the report you provide on your tax return and make sure it matches up.

You will receive Form 1098 if you made a payment for $600 or more to your lender to cover mortgage interest, including points, during the year. It’s also possible for you to receive year-to-date information on your mortgage interest by looking at the lender’s monthly bank statements.

-

Keep Your Records On Point

As we mentioned before, keeping good records is essential if you want to claim your mortgage interest tax deduction. You need to keep copies of Form 1098, which is the statement you receive from your lender letting you know how much mortgage interest you paid in the year. You also need to have the closing statement from refinancing and it needs to show the points you paid if at all, to refinance your property loan.

Keeping a record of the name, social security number, and address of the person who sold you the home is also a must if you’re paying mortgage interest to them. Not to mention you have to keep a record of the amount of mortgage interest and points you paid in the year. Additionally, you need to keep records of your federal tax returns from the year prior and all other relevant records. Do your research or consult with a professional to make sure everything’s in place and you have everything you need.

-

Itemize On Your Taxes

Mortgage interest tax deduction is claimed on Schedule A of Form 1040, which means you have to itemize your taxes instead of going for the standard deduction. Itemizing will make tax prep a bit more time-consuming. However, it will be worth your time if the itemized deduction is greater than the standard deduction because you’ll be saving money.

If the standard deduction is greater than the itemized one, including mortgage interest tax deduction, you should go for the standard one. So, if you are working with a tax professional, they will help you calculate your mortgage interest tax deduction and put everything together based on your circumstance. If you are filing by yourself, here’s a summary of what you need:

You need Form 1098 from your lender, so pay attention to your mail in January and February. Then, you have to determine if your deductions can be itemized. If you decide to make an itemized deduction, you can choose deductions such as student loan interest, medical expenses, mortgage interest, and more.

Add up the total mortgage interest stated on Form 1098 along with items such as state and local income tax, donations made to charity, and mortgage insurance. If the total is greater than the standard deduction, itemization could be the best option. Keeping good records needs to be a habit and it’s a must for your mortgage interest tax deduction.

Your records have to cover the last 7 years at least in case of an audit and you have to keep Form 1098 and any other documentation supporting deductions in those 7 years.

Standard Deduction Or Itemized Deduction?

Standard deduction and itemized deduction deserve their own section because it’s important to make the right choice; the choice that will save you the most money (and time, if possible). Itemizing deductions is the best option when the total of your mortgage interest and items such as private mortgage insurance, donations made to charity, and state and local taxes is greater than the standard tax deduction.

However, it’s important to note that the Tax Cuts and Jobs Act introduced in 2017 makes itemization less attractive for most people. Why? Because the act increased the standard deduction amount, which means it’s the option that makes the most sense. The law also lowered the threshold for the mortgage tax deduction allowed by mortgages. So, this is why itemized deduction is the attractive option only if they add up to more than the standard.

Mortgage interest rates were very low this past year, which means most people paid less in interest. In that case, the better option is to skip mortgage interest tax deduction and just go for the standard deduction. After the introduction of the law, that’s the most popular option.

Final Thoughts

Mortgage interest tax deduction can be great for some but not make much sense for others, so we hope today’s article can help you determine if it’s something you want to pursue or not. Though we’ve covered mortgage interest tax deduction very thoroughly, you can expand your reading by going straight to the source. This IRS resource on Home Mortgage Interest Deduction is a longer read, but it provides a ton of information.

Mortgage interest tax deduction can reduce the amount of tax you owe quite a bit, so if you qualify and decide it’s in your best interest to claim it, we hope today’s guide has put your mind at ease. It’s not a very complex process, especially not if you have the right resources and help.

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!