When Should I Finally Retire?

By Jaden Miller , August 24 2021

When you reach a certain age, one question lives rent-free in our minds: when can I retire? This is a question we ask ourselves even when we’re young. At that point, it’s a guessing game, but when you’re within 10 years of your retirement age, you should have a much clearer idea. Choosing when to retire is a very personal decision and it requires you to consider many different factors.

So what is the retirement age? How can you figure out when to retire? Some people do it in their 30s while others do it in their 60s and 70s. So, what is it? If you make your decision based on Social Security benefits, you can retire at 62 at the earliest. This will cut down your checks. The reduction will be 5/9 of one percent for each month before the official retirement age, up to 36 months.

If the number of months is greater than 36, the Social Security benefits will be reduced 5/12 of one percent for each month. There are calculators you can use that will tell you how your Social Security benefits will be affected so you can get a better idea. If your goal is to retire a lot earlier and you don’t want to wait until you’re 62, 65, or 70 years old, you have to make a good plan and work hard to reach your ideal goal.

Most people agree that retiring early provides great benefits. Though it’s not possible for everyone to retire at 30, you can still find a way to retire early. Granted, you have to consider not only what you’re willing to do to get there, but also how much money you’re giving up by retiring early. So, when can I retire? At the end of the day, whether you retire early or not is a personal decision and you have to consider your options very well.

Hopefully, this article will give you a good idea of where to start!

The Official Retirement Age

In America, the official retirement age varies depending on the year you were born, which is when you can start collecting Social Security benefits in full. The retirement age used to be 65 for people who were born in 1937 or earlier. People born between 1943 and 1954 can retire at 66. Those born in 1958 can retire at 66 and 8 months, while those born in 1959 can retire at 66 and 10 months.

The retirement age will continue to increase in two-month increments until everyone born in 1960 or later can retire at 67. You can start collecting Social Security benefits at age 62, but they are reduced to 70% of the full benefit. When it comes to Social Security benefits, the retirement age has increased in the past few years, but for Medicare, it remains at 65.

Why are we telling you about this? Well, because many people choose to retire at the official retirement age. This is when their Social Security benefits kick in and it really helps their finances. Of course, you are free to retire early as well, you just need to prepare. Whatever you decide, you need to make sure the time to retire is right from a financial perspective.

At the end of the day, it’s your finances that will help you determine what is retirement age for you.

What To Keep In Mind To Determine Your Retirement Age

When can I retire and when can I retire early are two of the most common questions and to answer them, you have to consider many important factors. Choosing your retirement age wisely is very important and it’s not something you can do without analyzing your finances. One of the most important things you need to do is calculate how much money you’ll need to live per year and consider your needs and wants.

That means you have to look at your lifestyle from a financial perspective and see what your costs are. When you’re looking at costs, you need to account for housing, food, insurance and consider expenses such as travels, gifts, hobbies, etc. Additionally, you have to consider future plans. For example, will you move? That factor alone can decrease or increase your cost of living.

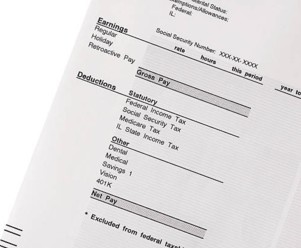

All in all, you have to analyze your income and expenses. Keeping track of your income is easy with tools such as paystub creator. It’s also important that you understand your spending habits very well. To help you with that, here are the 10 Best Budget Apps you can use. Now, what is it that you have to keep in mind about your income and your expenses?

To answer that, this next section will be divided into two and we will discuss the most important factors for each. All this will help you determine when is the best time for you to retire.

Income Factors

-

Social Security Benefits

In 2021, the average Social Security benefit is $1,543 every month. The full benefit, which is what you receive at the official retirement age, is $3,148 every month. When you reach the age of 70, your Social Security benefit maxes out and you get $3,895 every month. As mentioned earlier, you can get Social Security benefits at the age of 62, but you won’t get them in full.

Social Security benefits are important to consider because they are a big chunk of your retirement income. Though it may be subject to federal and state income taxes. To financial planners, the best game plan is to wait until you reach the official retirement age if you can. Your benefits will increase by 5 to 8 percent every year you delay, which is an incredible guaranteed return in this low-rate environment we live in.

You can delay your Social Security benefits application by either working longer or using your retirement funds. If you want a personalized estimate of your Social Security benefits, head to their website and create a My Social Security account to access that information.

-

Pension

Certain jobs in the private sector still provide pensions, most commonly known as defined benefit plans. Pensions are common if you work in the government or belong to a union. If you are receiving a pension, it’s definitely something you need to consider when you look at income. Usually, pension payouts start rolling in at the age of 65. If you start getting them early, the amount will be reduced.

It’s important to note that if you’re getting a pension from a job that doesn’t pay into Social Security, it will affect your benefits. This is due to the windfall elimination provision and it’s something teachers and state or local government workers need to keep in mind. You can learn more about the windfall elimination provision right here.

-

Retirement Funds and Savings

Your retirement funds and other savings are a huge part of your retirement plan. The rule of thumb is that you shouldn’t withdraw more than 4% in the first year of retirement. Of course, the amount needs to be adjusted every subsequent year based on the inflation rate. Let’s say that you withdraw $50,000 and the inflation rate stands at 5% that year.

That means you need to add $2,500 to the withdrawal you make the following year, which is the result of .05 times $50,000. You have to do that every year based on the inflation rate percentage. If you plan on retiring early, it’s recommended that you start by withdrawing 3% or less to compensate for bad market risk.

Of course, certain approaches will allow you to withdraw a higher percentage if you’re retiring early, as long as you’re willing to cut down your expenses on occasion.

-

Home Equity

Home equity can help you pay for retirement if you sell your house, move into a less expensive property, and use the amount you clear to strengthen your investment funds. A reverse mortgage is another option where you can borrow against your home equity. This will give you a lump sum, provide a stream of payments, or you can enjoy a line of credit.

Though reverse mortgages don’t require monthly payments, the amount of money you owe will increase over time. Usually, the amount is increased based on variable interest rates, so you will need to pay off the loan when you sell the home, move out, or pass away.

-

Inheritance

If you have a future inheritance coming, it can count as a source of income. However, it’s tricky to depend on it before you actually get it. The person giving you the inheritance could change their mind, make bad investment decisions, or need the money. Though inheritance can be considered as a part of your income, don’t count on it until you have it. If you count on it and then discover that you will no longer be getting it or it’s less than you anticipated, it can throw your retirement plan off course.

Expenses Factors

Expert financial planners recommend that you think of your expenses and divide them into three categories: needs, wants, and contingencies. For example, if your Social Security benefits or your pensions don’t cover all your needs, you should consider tapping into your savings to purchase an annuity. That would provide a larger stream of income and it would be guaranteed.

When it comes to your wants, the money should come from other income streams such as retirement funds or investments. Finally, your reserve for contingencies is precious and should be left untouched until you are faced with unexpected expenses.

-

Your Needs

Your needs are the expenses that you can’t live without and that you will need to cover and maintain your lifestyle. These expenses are different from your wants because your wants can be reduced or even eliminated if necessary. So, it’s important to make the calculations. Your needs, which are the costs you simply can’t reduce or eliminate are shelter costs, which include rent, mortgage, insurance, property taxes, repairs, and maintenance. There are also groceries, utilities, minimum debt payments, and more.

Transportation costs also fall into the needs category, which includes car payments, gas, insurance, repairs, and maintenance. Health care, other insurance, taxes, and any other mandatory expenses are all in this category. When it comes to taxes, most people’s rates are reduced when they retire, but taxes will still take 5 to 6 percent of a standard retiree budget. When you’re not working, you don’t have to pay Social Security or Medicare taxes.

However, you may still owe taxes on your Social Security benefits if you’re receiving income from additional sources. Not to mention, pension income and the withdrawals you make on your retirement plan are usually taxed.

-

Your Wants

Your wants are very different from your needs because you can put them off or eliminate them if you need to cut back expenses. These include eating out, traveling, clothes, entertainment, home furnishing, and home services such as housekeeping. If you’re investing and the markets take an extended downturn, your needs are the first expenses you have to reduce.

If your investments are doing great or if you receive an inheritance or any other windfall, you may increase the budget for your wants.

-

Your Contingency Plan

You know very well that you can craft a well-thought-out plan for your retirement but life is unpredictable, so you have to leave room on your budget for the unexpected because it’s bound to happen. A contingency plan is a must and it’s the money you won’t touch unless you are faced with an unexpected bill or expense, whether that’s a medical bill or a repair bill.

When you’re not working and you can’t increase your income, these expenses are more difficult to manage. That’s why any respectable financial planner will tell you that you need to set up a contingency plan. They recommend that you set aside 6 to 12 months’ worth of expenses for your emergency fund. That’s a good safety net to have.

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!