Understanding Payroll Management Software for Businesses

By Davis Clarkson , May 18 2025

Running a small business is definitely not simple, especially when it comes to managing payroll for employees. As part of payroll, making sure they get paid accurately and on time is extremely important. This also helps keep your employees motivated.

Handling payroll can be overwhelming. It’s a big job, and it’s easy to feel stressed. However, payroll management software is here to help you through this. These tools take the difficult part of payroll off your hands.

Then, they help to streamline the whole process. They also assist in minimizing errors and offering scalable solutions as your business grows.

In this article, we'll break down some of the best payroll software for small business. We’ll also highlight their features and pricing and how they can support your business's success for every payroll.

What Does Payroll Management Software Mean?

Payroll management software is the tool that makes it less stressful to pay employees. It is basically a digital tool that automates payroll. This then ensures that your employees are paid accurately and on time.

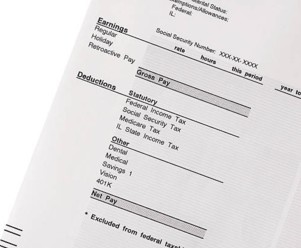

However, it does much more than just issue paychecks. A good payroll management software also manages employee income reporting. It does this while considering their hours worked, overtime, and salary agreements. It also automatically handles all tax deductions, including federal, state, and local taxes.

Now, you don't have to worry about manual errors that could lead to penalties. It also ensures all employees are paid accurately through direct deposit or any method your business operates in.

Some payroll software for small businesses has certain features like self-service portals. Employees can view pay stubs, download tax forms, and update personal details here. This then helps employers or HR teams avoid doing repetitive tasks or spending hours on payroll. You'll even be able to understand your business's payroll operations better.

Best Payroll Software for Small Business

Here are some of the best payroll software that works for small businesses:

ADP RUN

ADP RUN is a payroll management software that stands out for its features, which are designed to make payroll smooth. It supports various payment channels, including direct deposit, printed checks, and ADP prepaid cards. The tool differs from others because it automates complex processes. This includes tax calculation and deductions. It also manages employee retirement contributions. It also files forms like W-2s and 1099s.

This is a great choice for small businesses wanting to grow or enhance their HR operations. ADP RUN allows you to enhance your system with advanced capabilities, such as compliance alerts and overall HR services.

You should, however, note that if you mostly hire contractors, this may not be the right option. This is because it mainly focuses on full-time employees who work in an organization. It's great for small teams with under 50 employees. They can enjoy a customizable, full-featured payroll system. This software is scalable to fit businesses as they grow.

Features:

-

Allows centralized access to employee data like salaries, appraisals, and personal information

-

Offers payroll and compliance support across all U.S. states and 140+ countries

Pros:

-

It has a mobile app that has self-service tools for employees to use easily

-

Has the flexibility to add or remove features whenever needed

Cons:

-

Its advanced HR tools come with extra costs

-

It has no built-in time tracking, so you need a separate purchase for this

Price: Custom plans only

QuickBooks Payroll

Although QuickBooks is mostly associated with accounting, its payroll solution is also useful for small businesses. It provides an easy, hassle-free payroll system. It's perfect for teams with both employees and freelancers.

With QuickBooks payroll management software, you can pay your staff using the payment method they prefer. QuickBooks is great when it comes to tax filings and following any tax and legal compliance. It calculates federal and state payroll taxes, processes deductions, and files documents automatically.

Features:

-

Provides automated payroll with time tracking

-

Has an employee self-service portal

-

End-to-end payroll tax filing and payments

-

Provides expert setup assistance, which is available with premium and elite plans

Pros:

-

It’s easy to manage your payroll from anywhere in the world

-

It provides customizable and accurate financial and payroll reports.

Cons:

-

Limited features to support hourly payments for contractors

-

Offers no direct international payroll

-

The basic plan doesn't have features like same-day deposits and HR support

-

More expensive

Pricing:

-

Simple start: $85/mo + $6 per employee

-

Essential: $115/mo + $6 per employee

-

Plus: $184/mo + $9 per employee

Gusto

This software helps to simplify payroll, and it has a user-friendly interface. It provides useful reminders when in use. It's ideal for small business owners who want a reliable payroll management setup. It’s one of the top payroll software options for small businesses. It offers easy automation and customizable payroll features.

Features:

-

Provides a fully automated payroll and tax filing

-

Generates and files W-2 and 1099 forms

-

It automates garnishments like child support deductions and payments

Pros:

-

It allows payroll to run on schedule with its unique autopilot feature

-

Has smart adjustment features for minimum wage and for workers who usually get tipped.

Pricing:

-

Contractor Only: $35/month + $6 per person

-

Simple Plan: $49/month + $6 per employee

-

Plus Plan: $80/month + $12 per-employee fee

-

Premium: $180/month + $22 per employee

It is suitable for small businesses that are looking for easy automation and customizable payroll alerts.

Deel

If you have employees across multiple countries, then Deel is ideal for you. This global payroll provider helps run payroll and handles HR processes. It includes tax filings and legal compliance. Deel supports all types of employees, no matter their location. This includes full-time employees and independent contractors.

One big advantage is its smooth integration of payroll with HR, IT, and accounting. This keeps your workflows in sync. You spend less time fixing payroll errors. If you're looking for your small business to expand globally, this is the best option for you. You really do not have to set up physically in other countries.

Features:

-

Global payroll in 100+ countries, with more than 8 payment methods

-

You can pay any type of worker all at once

-

Offers multiple payout options: bank transfers, crypto, cards, and more

Pros:

-

Has the capacity to onboard quickly

-

Merges payroll with HR, finance, and IT features

-

Excellent 24/7 customer support

-

No extra costs

Cons:

-

It might feel complex at first for beginners

-

Costs can grow with team size due to per-user pricing.

Pricing:

-

Deel HR: from $15/employee/month

-

Deel Payroll: from $29/employee/month

-

Contractors: $49/month

-

EOR: $599/month

Rippling

Rippling is a strong workforce management software that combines IT, HR and finance into one system. It simplifies payroll with automation and compliance. This makes it easy for local and global teams to manage their payroll. It also supports different employment types and automates the entire payroll process.

If you want to hire employees from other countries, this software is for you. Rippling offers an EOR service that handles the essentials. This includes hiring, payroll, tax deductions, and benefits. It's perfect for tech-savvy small businesses and startups. They need a payroll solution that can grow as they do.

Features:

-

Provides accurate tax calculations and automatic filings

-

Supports both U.S. and international employees

-

Gives Employer of Record service for global hiring

-

Centralized platform to connect HR, IT, and finance systems

Pros:

-

Stress-free automation of payroll and tax processes

-

Smooth international hiring with built-in compliance tools

-

Has a modular setup, so you only pay for what you need

-

Provides centralized employee data, making admin tasks faster and more accurate

Cons:

-

Full HRIS functionality comes at an extra cost

-

Per-employee pricing means your costs grow as your team scales

Price: Starts at $8 per employee/month. Custom quotes are also available depending on the size and needs of your company.

In Summary

Choosing the right payroll management software is key for small businesses. It can help streamline operations. To do this, start by assessing what matters most to your business. This includes your team size, payroll frequency, budget, and how well it fits your business needs. Consider one that has a user-friendly interface. It should help you easily understand your payroll operations. With these, it should be quite easy to choose the right payroll that works for you.

While handling payroll, it is important to have your pay stubs and all tax documents ready. Our pay stub generator handles creating professional pay stubs that make payroll easier. Get started with us today!Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!