How Do Banks Verify Income For A Car Loan?

By Jaden Miller , September 18 2020

Found the perfect car? Congratulations! Wondering how do banks verify income for auto loan? When it comes to whether or not you will receive a car loan, many factors come into play. To make sure you understand these factors, we will be describing to you all the ways that banks use to decide whether or not to qualify any individual for a car loan.

By the end of this article, you will get a comprehensive idea of how banks make the decision and how do banks verify income for auto loan for both the individual and the bank. Do you want to know do banks verify income for auto loan? Get ready to become an expert on car loans!

Your Credit Score & Paystubs

Your credit score is the biggest factor that comes into play when a bank decides to verify your income prior to providing you an auto loan. Thus, if you have poor credit, you should automatically expect to have to verify your income. One of the key ways a company verifies an individual’s income is through paystubs. Read on to find out how it all connects and how do banks verify income for auto loan.

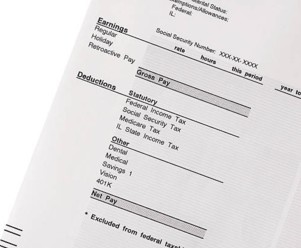

Paystubs are important proof of income documents that employers give employees. Most paystubs show the amount of money earned by an employee and the amount of money taken out of an employee’s paycheck due to taxes, insurance costs, etc. The difference between paystubs and W-2 forms is that paystubs include non-taxable income in their final income statement while W-2 forms do not.

People get car loans all the time but how do banks verify income for auto loan? Individuals applying, usually give proof of income through paystubs rather than W-2 forms when receiving a car loan. Credit scores usually range from 300 to 850. Thus, a good credit score is considered to be 670 or above. If your credit score is deemed. to be very poor or fair, you will definitely have to provide proof of income for a car loan.

If you're worried about your credit score and need to give it a boost, check out these tips to help you out! Often times there is a requirement for how much income you need to receive to get a car loan. So how do banks verify income for auto loan? Well, banks usually start here to understand if you can make your monthly loan payments. In most cases, the required income value is around $1500 to $2000 a month before taxes.

Consistently receiving at least this amount of money a month, proves to the banks that you are able to make the necessary monthly payments and take care of yourself and your loan.

The Price Of A Car

If the price of the car you want to purchase is expensive, then your lender will likely ask you to verify your income. In fact, most luxury cars require proof of income through pay stubs and other financial forms, regardless of a decent credit score. That means that people with poor credit will likely not even get a chance to have a loan considered for approval to buy an expensive car.

Amount Of Money Paid In Down Payment

If you have a good credit score, your lender will likely not require you to make a down payment on your new car. Although no one requires you to, making a down payment on your new vehicle, this is encouraged so as to lower the amount of money you must pay on it each month. Making a down payment on your new car will also lower the interest rate on your auto loan! This will save you money in the long run.

If you have bad credit, you will be required to make a down payment of either $1,000 or 10% of the car’s selling price. Add this to the car’s monthly statements and interest rates and things can get extremely expensive. On the other hand, if you can pay for your new car entirely in cash, you will not have to make any car payments at all. This also means no interest rates.

Whether your credit score is good or bad, paying for a car in cash is ideal. Still, confused about how do banks verify income for auto loan? Read on for one more very important factor.

Your Debt To Income Ratio (DTI)

A debt to income ratio is the cost of your bills each month divided by your income before taxes. If your debt to income ratio is high, your lender will want to verify your income through pay stubs and other financial documents. Once your lender verifies this information, he/she will decide if you qualify for a loan or not.

Honesty Is Always The Best Policy

Although it may be tempting to lie and say your credit score and income are higher than they actually are when purchasing your dream car, honesty is always the best policy. That means no fake pay stubs for a car loan. Faking paystubs and W-2 forms can get you in serious trouble with the law. This is especially true when there are so many ways to verify income.

In a nutshell, how do banks verify income for auto loan? Do your part to ensure a successful decent car loan is approved! If you want to ensure this, make sure that you have a decent credit score and that you are fully employed. Even if your credit score is good, it is wise to always bring along some pay stubs as proof of employment with you when purchasing a car. Choose a pay stub template from our gallery and let's get started using the check stub generator to create paystubs!

You might also want to check out the difference between FHA loan and conventional loan.

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!