How to Estimate Quarterly Taxes 1099 if You’re a Freelancer

By Davis Clarkson , May 8 2025

As a freelancer or independent contractor, you're not reporting to any boss. It's a perk, but it's not all sunshine and rainbows. You don't benefit from the company’s HR department to help with tax matters.

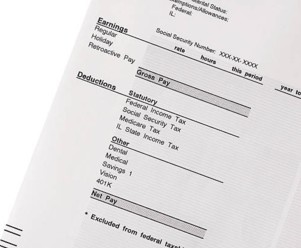

A standard employee has taxes taken out of their check bi-weekly or monthly. You, on the other hand, are required to pay your estimated taxes four times a year.

Many people find this process very daunting at the beginning. But you have no reason to fret when faced with a quarterly tax return.

In this article, we’ll discuss how to estimate quarterly taxes 1099, and much more.

What Are Quarterly Taxes for 1099 Contractors?

With the IRS, you don’t just wake up one day in December and pay your whole taxes for the entire year. You sort of pay them in bits during the year. For employees, employers provide for this through deducting taxes from wages or salaries paid to the employees.

If you are a freelance self-employed individual, that's not you. All these are payments that you have to make on your own through estimated quarterly taxes.

Also read: Can You Write Off Charitable Gifts On Your Taxes?

Who Needs To Pay Quarterly Taxes?

Not all those who earn 1099 income have to make these quarterly estimated tax payments. Taxpayers usually have to pay quarterly estimated taxes during the fiscal year based on one factor. That is, if they think that their tax obligation for the year will be at least $1,000. This is after deductions for tax withholdings and refundable credits, as per IRS rules.

Some people have a regular traditional job. But then, they also do freelance work on the side. These people may be able to change withholdings on their W-2 job. Then, it can take on some of those additional taxes from freelance work income. However, this may not be applicable where the self-employment income is a lot. That means the normal rule of every three months will apply.

How to Estimate Quarterly Taxes 1099

To estimate quarterly taxes 1099, you must estimate the overall income for the year. Then, you calculate the taxes to be paid. Here's how to approach this:

-

Calculate Gross Earnings

To begin with, you need to calculate the gross earnings for the year. This refers to all sources of income, including freelance work, investments, and rental income, among others. If you have been self-employed for a time now, then you can look at your income from the previous year as a standard.

-

Take out Business Deductions

Subsequently, you are supposed to subtract your estimated business deductions. This may include home office use, business travel, equipment acquisition, and other business needs. After this, there’s whatever is left. In this instance, it will be called your net business income.

-

Estimate Self-Employment Tax

This is followed by coming up with an estimate of the amount of deductions. That means what you are likely to be putting towards self-employment tax. To obtain this, you must ascertain the value of 15.3 percent of that income. You also need to determine the income tax you should pay as well.

This should be in line with the tax that applies to the income earned in your income class. It is possible to deduct half of that self-employment tax when it is time to compute the income tax.

Form 1040-ES, which the Internal Revenue Service employs, has a worksheet included. This aids in arriving at these estimates. You can also use a 1099 tax calculator.

-

Determine Quarterly Tax

For most people, dividing the estimated annual tax by four will give you your quarterly payment amount. However, some people experience changes in their income during the year. When this happens, the annualized income installment method is a good option. It allows your time for payments to be proportionate to when the income is earned.

Also read: Is Life Insurance Taxable?

When and How To Submit Your Payments

It is important to note that taxes are paid in equal installments, usually done quarterly. All things being equal, this is when you pay:

-

April 15

-

June 15

-

September 15

-

January 15 of the next year

These dates may vary a little bit if they are on weekends or holidays. So, you should always check the IRS website for information and dates for the current year.

The method of payment can be made through the following ways:

The IRS Direct Pay system. There is a payment without any fees directly from your bank account. It is easy to use since you only need to input your tax and payment information. You get a confirmation immediately.

Credit or debit card payments are accepted through third-party processors. However, they are those that have been approved in line with the IRS regulations. User fees normally range from 1.87% to 1.99% of the payment amount.

Another thing you can try is through a check or money order. This is what you will send in the mail. The check should be enclosed with a Form 1040-ES payment voucher and sent to the relevant IRS address.

What Happens if You Miss a Payment?

Not paying a quarter’s taxes on time is not the end of the world. But if this is you, you should find a way to resolve it as soon as possible. In such situations, you’ll usually pay a penalty. It will be related to how much tax the IRS has claimed you have failed to pay. Also, the time it has taken you to make the payment counts.

The underpayment penalty is 0.5 percent of the unpaid tax, for every full month the tax remains unpaid. It can only go up to 25 percent. Furthermore, there is also interest on the unpaid amount. The interest rates can also change every quarter.

Since it is unhelpful to delay, you need to pay your dues as soon as possible to avoid penalties. Even partial payments may lower the extra amounts that you will pay as a penalty.

Also read: Comprehensive Guide To Measuring Training ROI

How Do You Use a 1099 Tax Calculator?

A 1099 tax calculator can help reduce the chances of engaging in guesswork when doing your taxes. These tools usually require information like the expected income, the business expenses, the filing status, and the state of residence, after which the estimated quarterly payments are computed for you.

With the assistance of a 1099 tax calculator, it is possible to evaluate the potential tax amount. However, such tools do not reflect all the important details. In case of complicated finances, for instance, it lacks the necessary skills. If the person receives several sorts of income or has large business stakes, it is correct to consult a tax consultant.

Wrap Up

In summary, operating as a 1099 contractor implies managing taxes on a quarterly basis. For this, proper planning and knowledge of the tax legislation are essential. This can be achieved by estimating quarterly taxes 1099 amounts and making timely payments. You should also maintain sufficient records and claim allowable exemptions. Finally, in any case, if you are in doubt, it is always advisable to seek the assistance of an experienced tax advisor. They are more knowledgeable and will advise you according to your circumstances.

Easily track your income for tax season with our pay stub generator. Our platform helps freelancers generate accurate pay stubs. This makes estimated quarterly taxes 1099 calculations simple and stress-free. Stay organized and avoid surprises today!Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!